Income isn't the problem – structure is

As earnings rise, tax drag and fragmented advice erode momentum. We replace that complexity with systems designed for resilience.

Systems > decisions

Individual investments matter less than the structure they sit in. We focus on your overall trajectory – converting high income into control.

Momentum → endurance

We solve for structural friction as complexity grows. Rather than optimising spreadsheets in isolation, we design the system your decisions sit inside – outcomes depend on individual circumstances.

01

Foundation

Eliminate leakage and optimise entity alignment with goals and objectives

02

Momentum

Convert surplus income into asset-backed growth based on individual circumstances

03

Legacy

Decouple wealth growth from personal output and create legacy that endures

Externalise complexity

Internalise logic

You provide the numbers. We identify leaks, mis-sequencing, and overexposure.The result: a decision map of what to fix, what to ignore, and what to stage.

01

Initial alignment

15 minutes to clarify your current position and identify structural gaps

02

Wealth architecture

60 minutes to assess your structure across tax entities, cash flow, and asset deployment

03

Trajectory mapping

A forward-looking model that compares your current path to alternatives pathways

Principal

Xi (Benny) Yang

CFP®, M.FP, B.Bus, JP (NSW)

I work with creative principals whose income outpaced their structure.The most common failure point is not income – it's structure: fragmented advice, tax leakage, and reliance on personal output.Chief Money Group designs the architecture that converts momentum into endurance – income into a 10-year fortress.

A 15-minute alignment session to:

• Clarify your current trajectory

• Identify structural gaps and tax friction

• Determine whether wealth architecture is the right next step

This session provides general information only and does not constitue personal financial advice. Personal advice is only provided following a formal advice process and issuance of a Statement of Advice.

Thank you

Thanks for signing up.

Website Disclosure Information

Version 1.2

Prepared Date: 14th January 2026

Introduction to Insight Investment Partners Part 1

This Website Disclosure Information was prepared on 14 January 2026. This Website Disclosure Information should be read with the Adviser Profile document dated 14 January 2026.This Website Disclosure Information helps you understand and decide if you wish to use the financial services, we are able to offer you.The Licensee and its employees (including any employees of a related body corporate) are collectively referred to as “us, we, our” throughout this Website Disclosure Information.

This Website Disclosure Information sets out the services we provide. It tells you:-> who we are and how we can be contacted;

-> what services and products we are authorised to provide to you;

-> how we (and any other relevant parties) are paid; and

-> how we deal with complaints.

Lack of Independence

Insight Investment Partners is not able to describe itself as being independent, impartial or unbiased because we:-> receive commissions for the advice we provide on life risk insurance products; and

-> have an approved product list which limits the range of products we or our representatives can recommend when providing advice to you;Should we provide you with personal financial product advice, and you are a retail client, you will receive a Statement of Advice (SOA). The SOA is a record of our recommendations; the basis on which it is given, and information about commissions, fees, charges and any associations that may have influenced the provision of such advice.Where further advice is provided, we may not provide an SOA where the relevant circumstances and basis for advice have not significantly changed from the original SOA. However, we will provide upon request what is known as a Record of Advice (ROA). You can request this at any time from your adviser or by emailing or writing to us.Occasionally we provide general advice. This is where we may express an opinion or recommendation influencing you in making a decision in relation to a financial product, but where we HAVE NOT considered your personal objectives, financial situation or needs. If we provide you with general advice, we will provide you with a warning that the advice may not be appropriate to your needs, financial situation or objectives. Additionally, we will provide you with an applicable Product Disclosure Statement (’PDS’) (if one is available) which you should read before making a decision that the product is right for you.In the event we make a recommendation to you to acquire a particular financial product (other than listed securities) or offer to issue or arrange the issue of a financial product, we will also provide a Product Disclosure Statement (PDS). The PDS contains information about the risks, benefits, features and fees payable in respect of the product.The Licensee has arrangements in place to maintain professional indemnity insurance. This insurance satisfies the requirements under section 912B of the Act.

Who will be providing financial services to you?The Licensee

The Licensee is the authorising licensee for the financial services provided to you, and is responsible for those services.The Licensee authorises, and is also responsible for, the content and distribution of this Website Disclosure Information.The Licensee’s contact details are as follows:

-> Licensee name: Insight Investment Partners

-> AFSL number: 368175

-> Address: The Commons, 39 Martin Place, Sydney NSW, 2000

-> Website: www.iipdealergroup.com.au

-> Phone: 02 9181 3431

-> Email: [email protected]The Corporate Authorised RepresentativeThe Corporate Authorised Representative is the providing entity and is authorised by the licensee to provide financial services to you.Corporate Authorised Representative details:

-> Name: Chief Money Group Pty Ltd

-> Address: L35 100 Barangaroo Avenue, Sydney NSW 2000

-> Website: www.chiefmoneygroup.au

-> ASIC CAR number: 1314600

-> Phone: 02 9538 7155The individual authorised representatives are:

-> Name: Xi Benny Yang

-> ASIC AR number: 1306626

-> Phone: 02 9538 7155

-> Email: [email protected]You can provide instructions to us by contacting us using the contact details above.The Licensee and the Authorised Representatives listed in this Website Disclosure Information act on your behalf when we provide financial services to you.

What services and products are we authorised to provide to you?

We are authorised to provide financial product advice and deal (apply for, acquire, vary or dispose) in relation to:We are authorised to provide these services and products to both retail and wholesale clients.There is an important difference between ‘general advice’ and ‘personal advice’. If we provide you with ‘general advice’ it means that we have not considered any of your individual objectives, financial situation and needs.If we provide you with ‘personal advice’ we will consider your individual objectives, financial situation and needs when making our recommendation to you.In providing our services, other financial matters may arise, however, we are not authorised to assist with any financial and product services except those explained above. You should seek specific advice from the appropriate professionals on other matters relevant to you.

What fees and commissions are payable to us?

We will discuss and agree our fee structure with you before we provide you with services. Generally, the types of fees you can be charged are listed below. You may be charged a combination, or part of, any of these fees.Fees for Advice:

We may charge fees for the preparation, presentation and/or implementation of our advice. These fees will be based on your individual circumstances, the complexity involved in your situation and the time it takes to prepare personal financial advice for you. We will discuss these fees with you and gain your agreement to the fees before we provide you with advice.A flat dollar amount known as an advice fee may be charged from $550 -$22,000 (inclusive of GST).Service Agreements:

We may charge a fee to provide advice services and/or portfolio reviews. These agreements may be either on either a fixed term or ongoing basis.This fee will be agreed with you and is either a set amount, or an amount based on the amount of funds under our advice, and/or the time involved in reviewing your portfolio and circumstances.Payment methods

Our fees are either invoiced to you directly, or deducted from your investments, or a combination of these methods.Where it is debited from your investments it is normally referred to as the Adviser Service Fee.In most instances you will be able to select the method of payment that suits you best. We will discuss and agree the method of payment with you before we provide you with financial services.Life Insurance Products

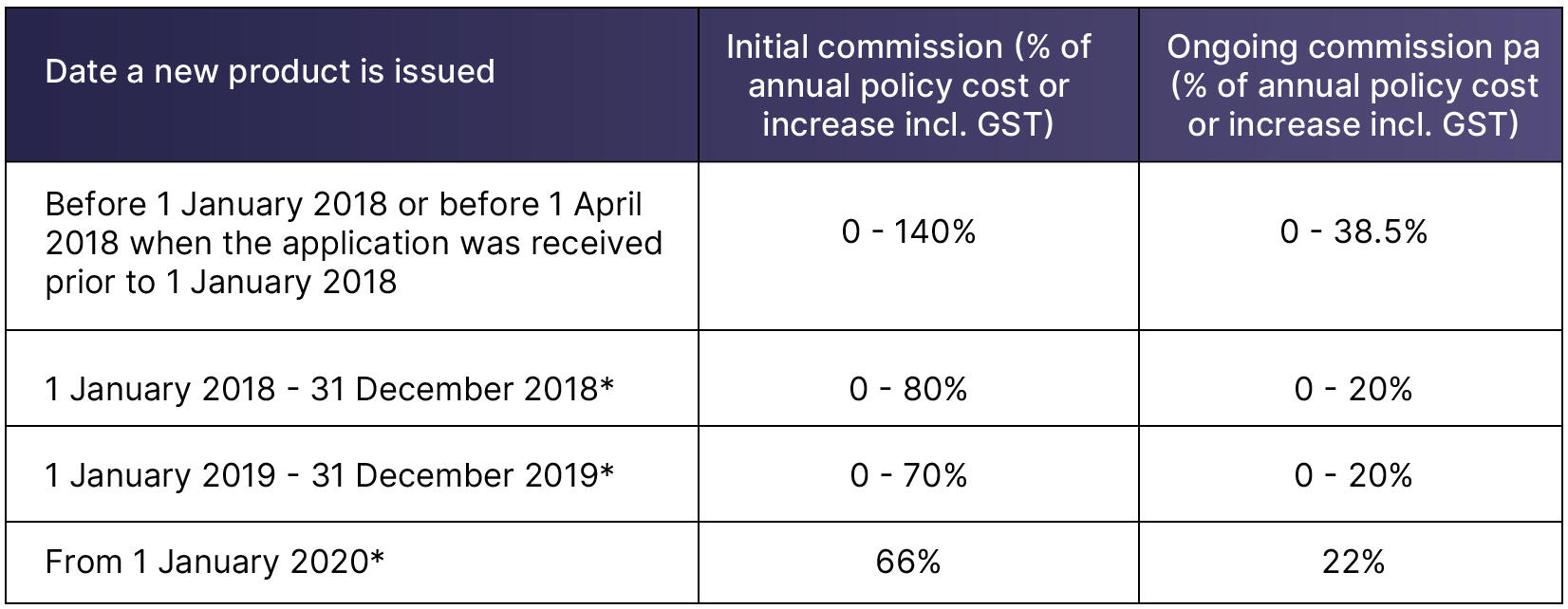

Initial and ongoing commissions from insurance providers may be received by Insight Investment Partners. These commissions are paid to Insight Investment Partners by the company that issues the product that we recommend to you and they are included in what you pay for the product. The commissions vary and are based on the policy cost, which is the sum of the premiums you pay and may include other fees related to the product.The initial commission is paid in the first year by the product issuer to Insight Investment Partners. Ongoing commissions are payments paid by product issuers to Insight Investment Partners in the years after the first year.

If you initiate an increase to your cover, we may receive an initial commission and ongoing commissions on the increase to your policy cost. The ongoing commission on a client-initiated increase is only paid in respect of the period that starts from the first anniversary of the increase.The maximum commission that Insight Investment Partners may receive is set out in the table below:

*We may receive the pre-1 January 2018 commission rates above from the product issuer, higher commission rates than those outlined in the above table if:-> your policy was issued before 1 January 2018, and you exercise an option or apply for additional cover under your policy after 1 January 2018; or

-> your policy was issued before 1 January 2018 and is replaced after 1 January 2018 to correct an administrative error.BrokerageWe may receive up to 100% of any brokerage fees charged for the execution of share trades. We may charge between 0% to 1.10% inclusive of GST (subject to a minimum of $110 inclusive of GST), on any share transaction. For example: an investment of $100,000 in direct shares, using a brokerage rate of 1.10% would equate to $1,100 (inclusive of GST) received by Insight Investment Partners.How are we remunerated?Insight Investment Partners directors and employees are remunerated by salary, and may also be awarded an annual bonus. Bonuses will depend on several factors including:-> company performance;

-> professionalism and adherence to compliance procedures; and

-> team performance.You may request more details about the way these people or entities are remunerated within a reasonable time after receiving this document and before any financial services are given to you.Do any relationships or associations exist that might influence my adviser in providing financial services to me?Your adviser may receive non-cash benefits with a cash value of less than $300. These may include, but not limited to, gifts, business lunches, sporting tickets or industry events (professional development or conference attendance).Should an adviser receive any non-cash benefit, the benefit is recorded in our benefits register, which can be made available upon your request.Our complaints handling procedures and how to access them

We are committed to meeting if not exceeding our clients’ expectations whenever possible. Insight Investment Partners endeavors to provide you with quality financial advice. If you have a complaint or concern about the service provided to you, we encourage you to take the following steps:1) Contact your adviser and tell your adviser about your complaint.

2) If your complaint is not satisfactorily satisfied in five business days, please email or write your complaint to [email protected]

3) If your complaint is not satisfactorily resolved within 30 business days, you have the right to contact the Australian Financial Complaints Authority (AFCA). AFCA independently and impartially resolves disputes between consumers, including some small businesses, and participating financial services providers.The Australian Financial Complaints Authority can be contacted on:-> Toll Free Telephone: 1800 931 678

-> GPO Box 3, Melbourne Vic 3001

-> Fax: (03) 9613 6399

-> Website: www.afca.org.au

-> Email: [email protected]4) The Australian Securities and Investment Commission (ASIC) is Australia’s corporate, markets and financial service regulator. ASIC contributes to maintaining Australia's economic reputation by ensuring that Australia’s economic markets are fair and transparent, and is supported by informed investors and consumers alike. ASIC seeks to protect consumers against misleading or deceptive and unconscionable conduct affecting all financial products and services. You may contact ASIC by:-> Toll Free Telephone: 1300 300 630

-> GPO Box 9827, Your Capital City or;

PO Box 4000, Gippsland Mail Centre Vic 3841

-> Website: www.asic.gov.auCompensation ArrangementsInsight Investment Partners holds a professional indemnity insurance policy, which satisfies the legislative requirements. Subject to the terms and conditions, the policy provides cover for claims concerning professional services provided by Insight Investment Partners.The policy provides coverage regarding claims made against us as a result of conduct of our representatives/employees and those who no longer work for us (but who did at the time of the relevant conduct).

Adviser Profile - Xi Benny Yang

This document is the Adviser Profile of the Website Disclosure Information dated 14 January 2026 and should be read together with the Website Disclosure Information.Corporate Authorised Representative details:-> Name: Chief Money Group Pty Ltd

-> ASIC CAR: 1314600

-> Address: L35 100 Barangaroo Avenue, Sydney NSW 2000

-> Website: www.chiefmoneygroup.au

-> Phone: 02 9538 7155The individual authorised representative details:-> Name: Xi Benny Yang

-> ASIC AR number: 1306626

-> Phone: 02 9538 7155

-> Email: [email protected]Your Financial Adviser is Xi Benny Yang. Xi Benny Yang's ASIC Authorised Representative number is 1306626.You can provide instructions by emailing [email protected]Lack of IndependenceInsight Investment Partners is not able to describe itself as being independent, impartial or unbiased because we:

-> receive commissions for the advice we provide on life risk insurance products; and

-> have an approved product list which limits the range of products we or our representatives can recommend when providing advice to you;What experience does your financial adviser have?

-> [April 2025 - Current] Months Experience as a Financial Adviser

-> 5 Years Experience as an Associate Adviser

(2 Years as Provisionally Authorised Adviser)

-> 2 Years Experience as a Director of a Startup

-> 1 Year Experience as an Adviser Support

-> 1.5 Years Experience as a Securities Implementation Administrator

-> 1 Year Experience as a Proprietary Derivatives TraderWhat qualifications and professional memberships does your financial adviser have?AR Name holds the following qualifications:-> Certified Financial Planner (CFP®)

-> Master of Financial Planning

-> Bachelor of BusinessWhat areas is your Financial Adviser authorised to provide advice on?Xi Benny Yang is authorised to provide financial services, including advice or services in the following areas:-> Basic Deposit Products

-> Non‐basic Deposit Products

-> Non‐cash Payment Facilities

-> Life Products – Investment Life Insurance

-> Life Products – Life Risk Insurance

-> Superannuation (including Self‐Managed Super Funds)

-> Retirement Savings Accounts

-> Managed Investment Schemes including Investor Directed Portfolio Services (IDPS)

-> Government Debentures, Stocks or Bonds

-> SecuritiesHow will your financial adviser be paid for the services provided?

- Xi Benny Yang is paid by a salary, and may also receive dividends from the business as a shareholder.

Privacy Policy

Version 1.2

Prepared Date: 14th January 2026

Privacy Policy

Chief Money Group Pty Ltd ("us", "we", or "our") operates www.chiefmoneygroup.au (the "Site"). This page informs you of our policies regarding the collection, use, and disclosure of Personal Information we receive from users of the Site.We are committed to protecting your privacy and ensuring that your Personal Information is handled in a safe and responsible manner. This Privacy Policy outlines our ongoing obligations to you in respect of how we manage your Personal Information.If the information does not disclose your identity or enable your identity to be ascertained, it will in most cases not be classified as 'personal information' and will not be subject to this privacy policy.Insight Investment PartnersInsight Investment Partners is committed to providing quality financial services to you and recognises the importance of safeguarding your personal information. This Privacy Policy outlines our ongoing obligations to you concerning how we manage your Personal Information.We have adopted the Australian Privacy Principles (APPs) contained in the Privacy Act 1988 (Cth) (the Privacy Act). The APPs govern how we collect, use, disclose, store, secure, and dispose of your Personal Information.A copy of the Australian Privacy Principles may be obtained from the website of the Office of the Australian Information Commissioner at www.oaic.gov.au.

1. What is Personal Information and Why Do We Collect It?

Personal Information is information or an opinion that identifies an individual. The types of Personal Information we collect include, but are not limited to:

-> Names

-> Addresses

-> Email addresses

-> Phone numbers

-> Financial information

-> Investment details

-> Tax File Numbers-> Any other information necessary to provide our servicesWe collect your Personal Information primarily to:

-> Provide tailored financial services to you

-> Comply with legal and regulatory obligations

-> Improve our servicesWe may also use your Personal Information for secondary purposes closely related to the primary purpose, in circumstances where you would reasonably expect such use or disclosure. You may unsubscribe from receiving communications from us at any time by using the unsubscribe link provided in our emails or by contacting us.We may also use your Personal Information to send newsletters, educational content, service updates and marketing communications that we believe may be relevant to you.

2. How We Collect Personal Information

We collect Personal Information through various means, including:

-> Face-to-face meetings

-> Telephone calls

-> Emails

-> Our websites

-> via Substack

-> Online forms

-> From third-party service providers

-> From publicly available sourcesWhere appropriate and possible, we will explain why we are collecting your information and how we plan to use it.

3. Sensitive Information

Sensitive Information is defined in the Privacy Act to include information or opinions about such things as an individual's racial or ethnic origin, political opinions, religious or philosophical beliefs, membership of a trade union or other professional body, criminal record, or health information.We will collect Sensitive Information only with your express consent unless required or authorised by law. Sensitive Information will be used by us only:

-> For the primary purpose for which it was obtained

-> For a secondary purpose that is directly related to the primary purpose

-> With your consent

-> Where required or authorised by law

4. Disclosure of Personal Information

We may disclose your Personal Information to third parties, including but not limited to:

-> Financial institutions and product issuers

-> Regulatory bodies such as ASIC and AUSTRAC

-> External auditors and compliance consultants

-> Legal and accounting professionals

-> IT and administrative service providers

-> Third parties where you consent to the use or disclosure

-> Where required or authorised by law

5. Use of Artificial Intelligence

We utilise Artificial Intelligence (AI) technologies to enhance our services and provide you with personalised financial advice. Our AI systems may process your Personal Information to:

-> Analyse financial data and investment preferences

-> Provide tailored product recommendations

-> Improve the efficiency and accuracy of our services

-> Provide compliance checks with the regulatory requirements.Data Security and PrivacyWe are committed to ensuring that all Personal Identifiable Information processed by our AI systems is secure. We implement robust security measures to protect your data from unauthorised access, alteration, or disclosure.SARA’s uses the Microsoft Azure Personal Identifiable Information (PII) API to automatically identify and redact personally identifiable information (PII) across all documents and responses.Microsoft Azure’s Azure Personal Identifiable Information (PII) API filters your client data in the SARA App to:

-> Detects 80 + predefined PII categories—names, phone numbers, Medicare numbers, TFNs, credit-card data, health identifiers, etc.

-> Outputs a clean, redacted version of the text while preserving conversational context.

-> Outputs from SARA containing Personal Identifiable Information are redacted with ***.Your RightsYou have the right to:

-> Be informed about the use of your Personal Information in AI systems

-> Access and correct your Personal Information

-> Object to the processing of your Personal Information for automated decision-makingIf you have any concerns about our use of AI technologies, please contact our Privacy Officer.

6. Sending Information Overseas For Administrative and Support Services

We may disclose Personal Information to overseas recipients located in the following countries for administrative support purposes:

-> India

-> PhilippinesThese overseas recipients provide administrative and support services that assist us in delivering our services to you efficiently.We take reasonable steps to ensure that these overseas recipients comply with the APPs and the Privacy Act. By providing your Personal Information, you consent to this disclosure. Please note that if the overseas recipient breaches the APPs, we may not be accountable under the Privacy Act, and you may not be able to seek redress under the Act.

7. Security of Personal Information

We are committed to ensuring that your Personal Information is secure. We implement a range of security measures to protect your Personal Information from misuse, interference, loss, unauthorized access, modification, or disclosure. These measures include:

-> Secure servers and encrypted data storage

-> Firewalls and security software

-> Restricted access to Personal Information

-> Regular staff training on privacy obligationsWhen your Personal Information is no longer needed for the purpose for which it was obtained, we will take reasonable steps to destroy or permanently de-identify it. However, we are required by law to retain certain information for a minimum of seven (7) years after our professional relationship ends.

8. Access to Your Personal Information

You have the right to access the Personal Information we hold about you and to update or correct it, subject to certain exceptions. If you wish to access your Personal Information, please contact us in writing.We will not charge any fee for your access request but may charge an administrative fee for providing a copy of your Personal Information.To protect your Personal Information, we may require identification from you before releasing the requested information.

9. Maintaining the Quality of Your Personal Information

It is important to us that your Personal Information is accurate, complete, and up to date. If you find that the information we have is not current or is inaccurate, please advise us as soon as practicable so we can update our records and continue to provide quality services to you.

10. Website Links

Our website may contain links to other websites of interest. However, we do not have any control over those website. Therefore, we are not responsible for the protection and privacy of any information you provide while visiting such sites, and such sites are not governed by this Privacy Policy. We recommend that you exercise caution and review the privacy policies applicable to the websites in question.

11. Policy Updates

This Privacy Policy may change from time to time and is available on our website. We will notify you of any significant changes by posting an updated version on our website and/or directly contacting you via email.

12. Privacy Policy Complaints and Enquiries

If you have any queries or complaints about our Privacy Policy or how we handle your Personal Information, please contact our Privacy Officer:Privacy Officer

Insight Investment Partners

Address: Level 10, 60 York Street, SYDNEY NSW 2000

Email: [email protected]We will acknowledge your complaint within five (5) business days and aim to resolve it promptly. If you are not satisfied with our response, you may contact the Office of the Australian Information Commissioner.Compliance with Other Laws

Our handling of Personal Information also complies with obligations under the Corporations Act 2001 (Cth) and regulations set by the Australian Securities and Investments Commission (ASIC).

13. Changes to this Privacy Policy

a. We reserve the right to modify or update this Privacy Policy at any time without prior notice.

b. Your continued use of the website after any such changes constitutes your acceptance of the new Privacy Policy.

14. Contact Us

a. If you have any queries, or if you seek access to your personal information, or if you have a complaint about our privacy practices, you can contact us at [email protected]

Terms & Conditions

Version 1.2

Prepared Date: 14th January 2026

Terms & Conditions

Please read these Terms and Conditions ("Terms", "Terms and Conditions") carefully before using www.chiefmoneygroup.au (the "Site") operated by Chief Money Group Pty Ltd ("us", "we", or "our"). This page informs you of our policies regarding the collection, use, and disclosure of Personal Information we receive from users of the Site.Your access to and use of the Site is conditioned on your acceptance of and compliance with these Terms. These Terms apply to all visitors, users, and others who access or use the Site.

By accessing or using the Site, you agree to be bound by these Terms. If you disagree with any part of the Terms, then you may not access the Site.Chief Money Group Pty Ltd reserves the right to review and change any of the Terms by updating this page at its sole discretion. When Chief Money Group Pty Ltd updates the Terms, it will use reasonable endeavours to provide you with notice of updates to the Terms. Any changes to the Terms take immediate effect from the date of their publication. Before you continue, we recommend you keep a copy of the Terms for your records.

1. Acceptance of the terms

a. Welcome to our website designed to provide a financial planning service. By accessing or using the site, you agree to be bound by these terms and conditions.

b. You accept the Terms by using or browsing the Website. You may also accept the Terms by clicking to accept or agree to the Terms where this option is made available to you by Chief Money Group in the user interface.

2. Copyright & Intellectual Property

a. The Website, the content, and all of the related products of Chief Money Group are subject to copyright. The material on the Website are protected by copyright under the laws of Australia and through international treaties. Unless otherwise indicated, all rights (including copyright) and the content and compilation of the Website (including but not limited to text, graphics, logos, button icons, video images, audio clips, Websites, code, scripts, design elements and interactive features) or the content are owned or controlled for these purposes, and are reserved by Chief Money Group or its contributors.b. All trademarks, service marks, and trade names owned, registered and/or licensed by Chief Money Group who grants to you a worldwide, non-exclusive, royalty-free, revocable license whilst you are a Member to:-> (i) use the Website pursuant to the Terms;

-> (ii) copy and store the Website and the material contained in the Websites in your device's cache memory; and

-> (iii) print pages from the Website for your own personal and non-commercial use. Chief Money Group does not grant you any other rights whatsoever in relation to the Website or the content. All other rights are expressly reserved by Chief Money Group.c. Chief Money Group retains all rights, title, and interest in and to the Website and all related content. Nothing you do on or in relation to the Website will transfer any:

-> (i) business name, trading name, domain name, trade mark, industrial design, patent, registered design or copyright, or

-> (ii) a right to use or exploit a business name, trading name, domain name, trade mark or industrial design, or

-> (iii) a thing, system or process that is the subject of a patent, registered design or copyright (or an adaptation or modification of such a thing, system or process), to you.d. You may not, without prior written mission of Chief Money Group and the permission of any other relevant rights owners; broadcast, republish, upload to a third party, transmit, post, distribute, show or play in public, adapt or change in any way the content or third party content for any purpose, unless otherwise provided by these Terms. This prohibition does not extend to materials on the Website, which are freely available for re-use or are in the public domain.

3. General Disclaimer

a. Nothing in the Terms limits or excludes any guarantees, warranties, representations or conditions implied or imposed by law, including the Australian Consumer Law (or any liability under them) which by law may not be limited or excluded.

b. Subject to this clause 5, and to the extent permitted by law:

-> (i) all terms, guarantees, warranties, representations or conditions which are not expressly stated in the Terms are excluded; and

-> (ii) Chief Money Group will not be liable for any special, indirect or consequential loss or damage (unless such loss or damage is reasonably foreseeable resulting from our failure to meet an applicable Consumer Guarantee), loss of profit or opportunity, or damage to goodwill arising out of or in connection with the content or these Terms (including as a result of not being able to use the content or the late supply of the content), whether at common law, under contract, tort (including negligence), in equity, pursuant to statute or otherwise.c. Use of the Website and the content is at your own risk. Everything on the Website and the content is provided to you 'as is' and 'as available' without warranty or condition of any kind. None of the affiliates, directors, officers, employees, agents, contributors and licensors of Chief Money Group make any express or implied representation or warranty about the content or any products or content (including the products or content of Chief Money Group) referred to on the Website. This includes (but is not restricted to) loss or damage you might suffer as a result of any of the following:

-> (i) failure of performance, error, omission, interruption, deletion, defect, failure to correct defects, delay in operation or transmission, computer virus or other harmful component, loss of data, communication line failure, unlawful third party conduct, or theft, destruction, alteration or unauthorised access to records;

-> (ii) the accuracy, suitability or currency of any information on the Website, the content, or any of its content related products (including third party material and advertisements on the Website);

-> (iii) costs incurred as a result of you using the Website, the content or any of the products of Chief Money Group; and

-> (iv) the content or operation in respect to links which are provided for your convenience.d. Digital Communications & Substack Newsletter

Chief Money Group Pty Ltd may provide general information via email newsletters, electronic communications, or other digital content channels. Any information provided is of a general nature only and does not take into account your personal financial situation, needs, or objectives. Nothing in these communications constitues personal financial advice, and you should not act on any information without obtaining professional advice tailored to your circumstances. To the extent permitted by law, Chief Money Group Pty Ltd accepts no liability for any loss arising from reliance on information contained in such communications.Subscriptions & Unsubscribing: By subscribing to our newsletter, you consent to receiving communications from us. You may unsubscribe at any time using the links provided in our Substack emails. Use of subscriber information is governed by our Privacy Policy.

4. Limitation of Liability

a. Chief Money Group's total liability arising out of in connection with the content or these Terms, however arising, including under contract, tort (including negligence), in equity, under statute or otherwise, will not exceed the resupply of the content to you.b. You expressly understand and agree that Chief Money Group, its affiliates, employees, agents, contributors, and licensors shall not be liable to you for any direct, indirect, incidental, special consequential or exemplary damages which may be incurred by you, however caused and under any theory of liability. This shall include, but is not limited to, any loss of profit (whether incurred directly or indirectly), any loss of goodwill or business reputation and any other intangible loss.c. You acknowledge and agree that Chief Money Group holds no liability for any direct, indirect, incidental, special consequential or exemplary damages which may be incurred by you as a result of providing your content to the Website.

5. Termination of Contract

a. If you want to terminate the Terms, you may do so by providing Chief Money Group with 30 days' notice of your intention to terminate by sending notice of your intention to terminate to Chief Money Group via the 'Email' link on our homepage.b. Chief Money Group may at any time, terminate the Terms with you if:

-> (i) you have breached any provision of the Terms or intend to breach any provision;

-> (ii) Chief Money Group is required to do so by law;

-> (iii) Chief Money Group is transitioning to no longer providing the Services to Members in the country in which you are resident or from which you use the service; or

-> (iv) the provision of the Services to you by Chief Money Group, is in the opinion of Chief Money Group, no longer commercially viable.

c. Subject to local applicable laws, Chief Money Group reserves the right to discontinue or cancel your access at any time and may suspend or deny, in its sole discretion, your access to all or any portion of the Website or the Services without notice if you breach any provision of the Terms or any applicable law or if your conduct impacts Chief Money Group's name or reputation or violates the rights of those of another party.d. When the Terms come to an end, all of the legal rights, obligations, and liabilities that you and Chief Money Group have benefited from, been subject to (or which have accrued over time whilst the Terms have been in force) or which are expressed to continue indefinitely, shall by unaffected by this cessation, and the provisions of this clause shall continue to apply to such rights, obligations and liabilities indefinitely.

6. Indemnity

a. You agree to indemnify Chief Money Group, its affiliates, employees, agents, contributors, third party content providers and licensors from and against:

-> (i) all actions, suits, claims, demands, liabilities, costs, expenses, loss and damage (including legal fees on a full indemnity basis) incurred, suffered or arising out of or in connection with your content;

-> (ii) any direct or indirect consequences of you accessing, using or transacting on the Website or attempts to do so; and/or

-> (iii) any breach of the Terms

7. Dispute Resolution

a. Compulsory:

If a dispute arises out of or relates to the Terms, either party may not commence any Tribunal or Court proceedings in relation to the dispute, unless the following clauses have been complied with (except where urgent interlocutory relief is sought).b. Notice:

A party of the Terms claiming a dispute ('Dispute') has arisen under the Terms, must give written notice to the other party detailing the nature of the dispute, the desired outcome and the action required to settle the Dispute.c. Resolution:

On receipt of that notice ('Notice') by that other party, the parties to the Terms ('Parties') must:

-> (i) Within 30 days of the Notice endeavour in good faith to resolve the Dispute expeditiously by negotiation or such other means upon which they may mutually agree;

-> (ii) If for any reason whatsoever, 30 days after the date of the Notice, the Dispute has not been solved, the Parties must either agree upon selection of a mediator or request that an appropriate mediator be appointed by the President of the Conflict Resolution Service or his or her nominee;

-> (iii) The Parties are equally liable for the fees and reasonable expenses of a mediator and the cost of the venue of the mediation and without limiting the foregoing undertake to pay any amounts requested by the mediator as a pre-condition to the mediation commencing. The Parties must each pay their own costs associated with the mediation;

-> (iv) The mediation will be held in Sydney, Australia.d. Confidential:

All communications concerning negotiations made by the Parties arising out of and in connection with this dispute resolution clause are confidential and to the extent possible, must be treated as "without prejudice" negotiations for the purpose of applicable laws of evidence.e. Termination of mediation:

If 30 days have elapsed after the start of a mediation of the Dispute and the Dispute has not been resolved, either Party may ask the mediator to terminate the mediation and the mediator must do so.

8. Venue and Jurisdiction

The Services offered by Chief Money Group is intended to be viewed by residents of Australia. In the event of any dispute arising out of or in relation to the Website, you agree that the exclusive venue for resolving any dispute shall be in the courts of NSW, Australia.

9. Governing Law

The Terms are governed by the Laws of NSW, Australia. Any dispute, controversy, proceeding or claim of whatever nature arising out of or in any way relating to the Terms and the rights created hereby shall be governed, interpreted and construed by, under the pursuant to the laws of NSW, Australia, without reference to conflict of law principles, notwithstanding mandatory rules. The validity of this governing law clause is not contested. The Terms shall be binding to the benefit of the parties hereto and their successors and assigns.

10. Independent Legal Advice

Both parties confirm and declare that the provisions of the Terms are fair and reasonable and both parties having taken the opportunity to obtain independent legal advice and declare the Terms are not against public policy on the grounds of inequality or bargaining power or general grounds of restraint of trade.

11. Severance

If any of these Terms is found to be void or unenforceable by a Court of competent jurisdiction, that part shall be severed and the rest of the Terms shall remain in force.

12. Contact Us

If you have any questions or comments about these terms and conditions, please contact us at [email protected]